After filling out a short questionnaire, we’ll share your info with a partner lender to jumpstart the application process. By giving us permission to share your QuickBooks info and answers, you’ll save time and effort while applying with partners. The only real downside of the QuickBooks Capital Marketplace is that the options are somewhat limited. You may be able to access other forms of financing for your small business by working with a provider directly. And, keep in mind that even though they’re partnered with QuickBooks, those listed in the Marketplace all come with their own applications and eligibility requirements your business may or may not satisfy. QuickBooks Marketplace helps you determine if you’re eligible (and for how much) quickly.

Most want to see at least 12 months of your QuickBooks accounting history in order to provide you with offers and gauge your creditworthiness. Even though access to credit through the QuickBooks Marketplace is faster than applying through many traditional lenders, you can’t simply set up an account and apply for funding. Comparing your options on the QuickBooks Capital does not impact your personal credit history or your business credit score in any way.

- At the city’s southern outskirts, near the historic Pyrohiv village, there is an outdoor museum officially called the Museum of Folk Architecture and Life of Ukraine.

- If you decide to move forward with a funding application, QuickBooks can share some of the information you provide (with your consent, of course!) with financing partners to help speed up and streamline the application process.

- Some of the buildings are restored and turned into a museum, while others are in use in various military and commercial installations.

- Because B2B business loans are term loans much like a bank, they also have many of the same requirements.

- Newer businesses and businesses with fair credit can qualify for funding as long as their revenues are sufficient to make loan payments.

From there, most of the application will be automatically filled in from information in your account. Check to ensure everything is accurate, add any missing details, and submit the application. The QuickBooks Capital team will follow up with any questions or request any additional documentation. You should get a response about whether you are approved for QuickBooks Financing, typically within a few business days. Make sure all records in your QuickBooks account are up-to-date.

Loans for expansion and growth

During the Soviet era, as the city was expanding, the number of raions also gradually increased. Within the city the Dnieper River forms a branching system of tributaries, isles, and harbors within the city limits. The city is close to the mouth of the Desna River and the Kyiv Reservoir in the north, and the Kaniv Reservoir in the south.

- Our simple 15-minute application gets you on your way to funding quickly.

- However, there are times when debt financing is actually the most cost-effective strategy for growing a successful business.

- QuickBooks working capital loans help businesses stabilize their finances during periods of fluctuating revenue.

- Using that information, QuickBooks shows you customized offers for your business from multiple financing partners.

- In many ways, B2B lending services operate in much the same manner as a traditional bank loan, with similar loan terms and conditions.

If QuickBooks Capital is unable to match you with an offer from one of its financing partners, don’t be discouraged. You can always work with them directly to secure working capital, although it may require getting together some additional documentation for your application. Actual funding time can vary depending on third party processing time. Yes, QuickBooks Capital is a legitimate lending service offered by Intuit in partnership with WebBank.

QuickBooks Capital’s rates are on par with those of other online lenders, but there are no closing fees or origination fees — a definite advantage over the competition. Still, the financing is not cheap, and you’ll have to pay your loan back fairly quickly. That said, QuickBooks Capital could be an excellent source of fast funds, especially if you have a seasonal or young business that may not be approved elsewhere. You can apply using your QuickBooks data – the system pre-fills any request with information from your QuickBooks account, in just a matter of minutes.

Access competitive rates³

However, the prevailing south wind blew most of the radioactive debris away from Kyiv. Occupied by Russian troops since the 1654 Treaty of Pereyaslav, Kyiv became a part of the Tsardom of Russia from 1667 with the Truce of Andrusovo and enjoyed a degree of autonomy. At least three Arabic-speaking 10th century geographers who traveled the area mention the city of Zānbat as the chief city of the Russes.

You have the option to set up automatic payments or make manual payments toward your line of credit. There are no prepayment penalties or late fees, and you don’t make payments if you don’t use your line of credit. While your business information is used to underwrite a QuickBooks Term Loan, as the guarantor, you’ll be responsible for repaying the loan in the event your business can’t. So your personal credit history provides important information that helps determine whether you qualify to guarantee the loan. See funding options from our partners including line of credit and term loan, all within QuickBooks.

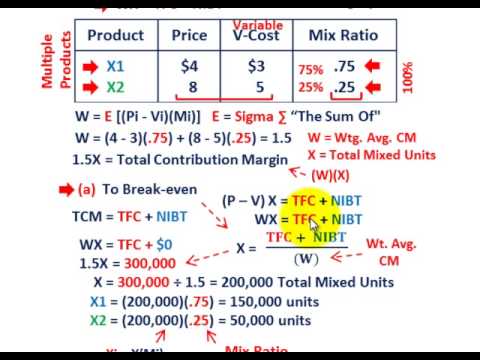

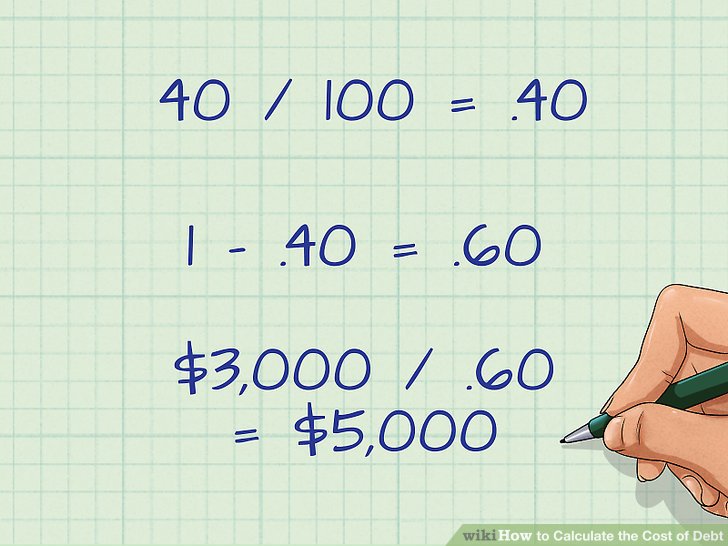

Your Annual Percentage Rate, or APR, is the annual rate charged for borrowing money. This rate is expressed as a percentage that reflects the annual yearly cost of funds over the term of the loan. Quickbooks Term Loan has no origination fees, therefore, the APR will equal the interest rate. For loans that charge fees or points, the resulting APR will be higher than the interest rate. When shopping for a loan, compare the APRs of at least two offers with the same term. Use the Capital tab in QuickBooks to find partner offers on loans and lines of credit.

Final Verdict: Is A QuickBooks Capital Loan The Best Option For Your Small Business?

The Golden Gate is a historic gateway in the ancient city’s walls. The name Zoloti Vorota (Golden Gate) is also used for a nearby theatre and a station of the Kyiv Metro. The National Museum of the History of Ukraine in the Second World War is a memorial complex commemorating the Eastern Front of World War II in the hills on the right-bank of the Dnieper in Pechersk. Kyiv Fortress is the 19th-century fortification buildings situated in Ukrainian capital Kyiv, that once belonged to western Russian fortresses. These structures (once a united complex) were built in the Pechersk and neighbourhoods by the Russian army. Some of the buildings are restored and turned into a museum, while others are in use in various military and commercial installations.

Beyond direct support, QuickBooks Capital also offers a marketplace for partner loans. This feature allows you to explore additional financing options from other reputable lenders, giving you more flexibility and choice in securing the funds your business needs. Whether you need a QuickBooks Capital loan or are exploring other options, their support infrastructure is designed to help you make informed decisions and manage your business finances effectively. Yes, your business credit history is reported, which can help build your credit profile.

Available Loan Products:

QuickBooks Capital is a financing solution provided by Intuit, designed to offer small business owners fast and simple access to capital. Integrated directly into the QuickBooks accounting software, the platform streamlines the entire capital application process, from applying for a loan to managing repayment. By leveraging your business credit history, sales trends, and cash flow data, QuickBooks Capital simplifies eligibility and provides personalized loan options with competitive rates. Whether you need to cover operational expenses, manage cash flow gaps, or fund growth opportunities, QuickBooks Capital loans are tailored to meet your needs. QuickBooks Capital is a service offered by Intuit Financing Inc. that helps businesses access a variety of credit offerings, such as peer-to-peer loans, small business administration loans, and short and long-term loans. QuickBooks Capital works by leveraging the financial data within QuickBooks to provide customized business funding options to eligible businesses.

Ready to get started invoice financing in Canada and the United States? See if you qualify for our invoice funding solution, or connect your QuickBooks account to FundThrough to get started. Instead, the overall health of your client’s business and their personal guarantor are taken into consideration. The fees for Fundbox are transparent and can paid weekly spread across 12 or 24 weeks; you decide. If approved, you will also be given the option to waive all remaining fees by paying back the full loan amount early.

As a result, Kyiv’s central districts provide a dotted contrast of new, modern buildings among the pale yellows, blues, and greys of older apartments. Urban sprawl has gradually reduced, while population densities of suburbs has increased. The most expensive properties are in the Pechersk and Khreshchatyk areas. It is also prestigious to own a property in newly constructed buildings in the Kharkivskyi neighborhood or Obolon along the Dnieper. A 2015 study by quickbooks capital the International Republican Institute found that 94% of Kyiv was ethnic Ukrainian, and 5% ethnic Russian.90 Most of the city’s non-Slav population comprises Tatars, South Caucasians, and other peoples from the former Soviet Union.

In order to show you options, our partners may do a soft pull of your personal credit. A soft pull won’t affect your personal credit score in any way. Once approved, get access to your funds in as fast as 1–2 business days1 from QuickBooks Capital partners committed to flexible repayment options and clear terms. Unlike many other funding options, offers on the QuickBooks Capital Marketplace don’t include additional fees, hidden or otherwise. You’ll know exactly how much you’ll pay upfront before agreeing to an offer, along with how much your monthly or weekly repayments will be.